Technical Analysis

Technical Analysis XRP/USD 28/09/2017

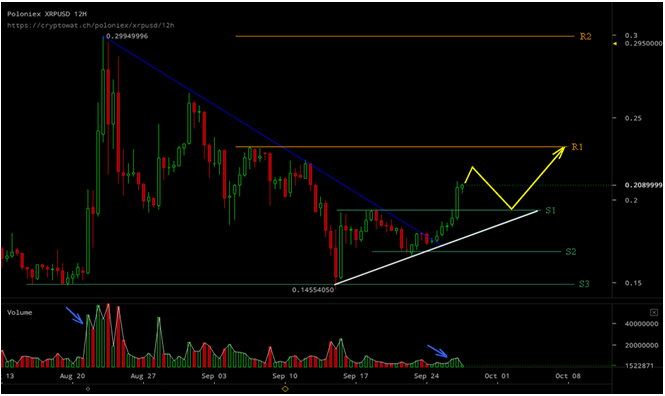

At the time I write the technical analysis, XRP/USD broke the resistance area R1 0.19usd and climbed to the resistance area R2 0.23usd. This upward move was predicted in the latest technical analysis. On the graph you can see that the price had broken the descending trend line (blue), one day ago. This upward movement of the XRP/USD parity is due to the upward movement of Bitcoin. Bitcoin broke the downward trend line and the bear trend is currently being denied. This fact has positively influenced the entire Crypto Market.

The resistance lines are: The support lines are:

R1 – 0,23usd S1 – 0,19usd

R2 – 0.30usd S2 – 0,17usd

S3 – 0,15usd

What surprised me is that this increase in XRP/USD was made with small volume traded. For comparison, look at the blue arrows at the bottom of the chart. However, it is a positive thing, because this growth seems much healthier than the pump and dump move up to 0.30usd in August.

Depending on the optimism on the market, the resistance zone R1 0.23usd can be reached or not. Whether the XRP/USD price will climb up to 0.23usd, in the coming days I expect a correction on XRP/USD. But I expect the corrective wave that will develop to stop at S1 0.19usd, or worst case line trend (ascending), drawn in white.

For the next two days, the possible evolution of the XRP/USD price is drawn in yellow on the chart.

Any positive news about Ripple, or negative movements of the Bitcoin price, may positively or negatively affect this technical analysis.

Mohsen

September 30, 2017 at 6:05 pm

Hey thanks for sharing your analysis .

Can you elaborate where is the price on the 1 and 2 and 3 of okt in the chart?

Best mohsen

ahmadderar

September 30, 2017 at 10:00 pm

the prices at S1, S2, S3 are clearly mentioned above the image. Where are written, “support areas” are also given the prices