Investing Tips

The Whales Of The Crypto Ocean

Whenever I read articles or opinions about whales on the internet, I found that it is a fairly controversial topic. In principle, experienced traders know the role of whales and know that it is good to follow them. There are also many whale reviews that come especially from beginners who bought a dear currency and burnt out because of whales. Articles about whales have been written yet, but all those articles seem superficial to me. This article shows you the whales exactly as they are.

But what is a whale? In the specific Crypto Market language, a whale is a person who has significant amounts of fiat or Bitcoin account. With these sums of fiat or Bitcoin, the whale can move the trend in a positive (when buying) or negative (when selling) trend. Wallets are not necessarily individuals. In the whale category, speculation funds, hedge funds, and even banks can enter.

Whales can also be classified by their size. Can be baby whales ($100k-500k USD), medium whales ($500k-2milions USD), large whales (over $2milions USD). Of course, this classification is indicative. Now let’s get a little bit into the theory of trend formation and see exactly the role of whales in price movement and the formation of trends.

As we all know, the price movement of a listed currency is due to demand and supply present on the market at that time. More precisely, the price will fluctuate due to price differences between bid and ask orders.

And yet, this is a simplistic explanation of the price movement. In fact, what causes prices to move up or down is market sentiment. In short, if the market is optimistic, the price will increase, if the market is pessimistic the price will decrease. In fact, the traders’ emotions are the ones that make the price rise or fall. When market sentiment is optimism, traders will go and buy coins directly from askers’ (ask) price. This will slowly, slowly, increase the price. When the market is pessimistic, traders sell their coins directly at the buyer’s price (bid). This slows down slowly when prices drop. Now that we know traders’ emotions are the ones that govern demand and supply, let’s get to the whales.

In principle, every whale builds its buy and sell strategy on two stages: accumulation and distribution.

What does the accumulation phase mean? In the accumulation phase, whales buy large amounts of cheap money. To do this they use various tricks. One of the tricks is placing “sell walls” order. Placing these sales walls on the market has a double effect. In this way, other big and small buyers are intimidated and are not buying yet. At the same time, there is a category of beginners who already have the currency bought and are at a small loss. They are intimidated by those selling walls and sell. Easily, the whales buy large amounts of coins from “weak hands.” Later, when the quantities of coins accumulated are sufficient, the whales raise the sales walls.

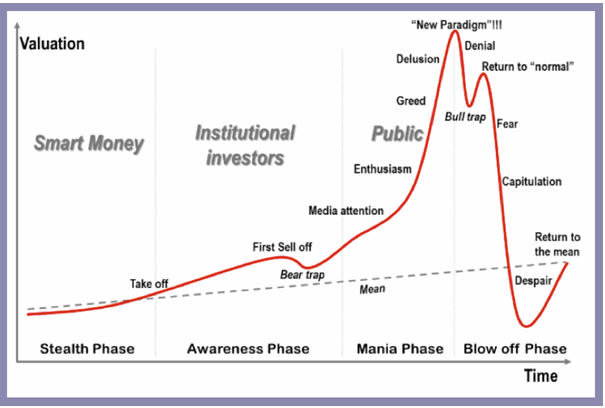

An image sometimes says more than 1000 words. Below, you have an image that explains the phases of a “Bubble.”

Who are the whales in this picture? Well, the whales are Smart money and Institutional investors. Of course, in the Smart money category, there is also a small amount of small and medium-sized investors who have experience in this market and know the opportunities to buy. After the walls were picked up by individual, easy whales, the Institutional Investors category was bought.

Soon the currency comes to the media’s attention. Articles appear on blogs, or even in the classical economic press. Also, this currency can also get the attention of television channels and YouTube channels. And so, that currency comes to the attention of the big public. People who watch such shows and read the economic press will start buying the currency. The latest buyers will be those who have no idea about the currency or Crypto Market but have heard from friends or acquaintances that they could make some money if they buy it.

Throughout this price increase, the whales will intervene when needed. In general, whales will buy large quantities of crypto coins for sale. Wallets will buy those mini-walls for sale. Medium or medium size buyers will be allowed to buy normal size orders. Well, when a taxi driver in New York will tell you that he knows a good opportunity to make money and will specify that currency, know it’s time to sell. A Bubble is close.

Whatever the whales will start to sell. The “distribution” phase will begin. Whale sales are usually aggressive if their profit target has been reached, or if they feel that the market is showing signs of weakness. A great importance in the whaling strategy is money management. Everything is very accurate. Wallets know exactly how much they can buy during the rising race after they have purchased large amounts of cheap coins. Generally, their plan works and gives very good results. There is the myth that whales never lose money. It’s just a myth. They can lose money when special events with negative impact occur on the market. There is also a small “no-radar” whale that randomly swims in the Crypto ocean.

There are other issues here. The Crypto Market is full of coins. The above scenario refers to a top 10 Crypto Market coin. A single whale cannot move those coins. It takes a whaling gang to move up a top coin (BTC, ETH, XRP, BCH). A currency can be moved much easier when the initial issue of coins is low and the currency is cheap. Many coins on the Crypto Market are regularly pumped and dumped by a single whale or two. Those coins never come to the attention of television channels or classical media but are being discussed on various forums or on various YouTube channels.

Everyone will draw his or her own conclusions after reading this article. It is certain that whales are the ones that initiate the trend and often help it move up. They are also responsible for aggressive sales. If we follow the whales and we will not be against them, they will make nice money. Every time you buy, you should look at a historical chart of the currency you want to buy and ask yourself if the price is expensive or inexpensive. The rule, “buy cheaper and sell expensive,” will keep you from going against whales.